Imagine an investor seeking to gain in turbulent markets, convinced a specific asset – a stock, index, or currency – is poised for a decline, but not necessarily a catastrophic crash. They are looking for a structured product offering capital protection with amplified returns if their moderately bearish view plays out within defined boundaries, coupled with the potential for early exit and capital return should the market move favourably enough.

Enter the Bearish Sharkfin Note with Early Redemption – a solution precisely engineered for such uncertain conditions. This offering, recently recognized as the Best Structured Investment and Financing Solutions in Equity at The Asset Triple A Private Capital Awards 2025, exemplifies the kind of expertly tailored investment solutions manufactured by BNP Paribas Wealth Management to align with current market dynamics marked by uncertainties and tariff turmoil. The Asset team identified its innovative design while analyzing structured solutions that distinguish themselves in the market, a key focus of these awards.

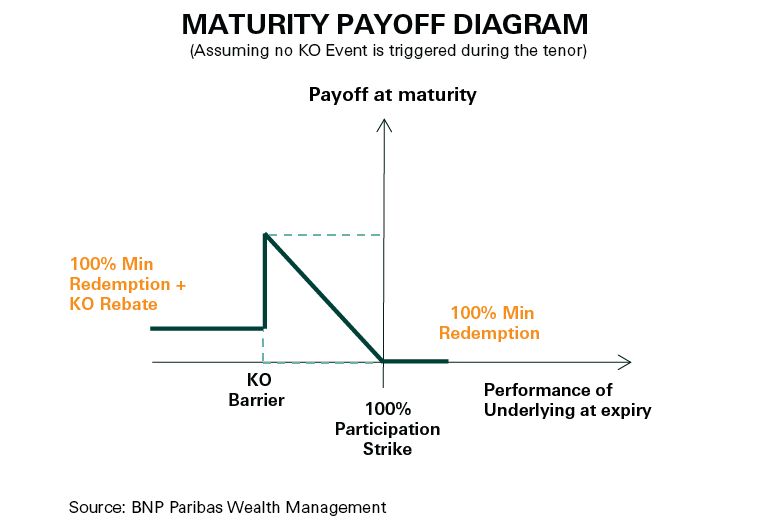

Its "best case scenario" isn't solely the asset crashing moderately at maturity; it also includes an advantageous early conclusion: if the asset price hits a predefined knock-out level during the term, the note redeems early. This offers the investor their principal plus an attractive predetermined return, providing valuable flexibility to immediately redeploy capital into new opportunities. However, if early redemption doesn't occur, the optimal maturity scenario unfolds when the underlying asset experiences a moderate decline throughout the note's term, falling significantly enough to maximize participation in the downside, yet crucially, never breaching a predefined knock-out barrier before maturity. At maturity, in this case, the asset price sits comfortably between the strike price and the knock-out barrier, allowing the note to capture its maximum potential upside-down return.

Together, these dual positive outcomes – early exit with a gain upon knock-out, or maximized bearish return at maturity within safe bounds – represent the pinnacle of this award-winning Bearish Sharkfin's design. This structure rewards calculated bearishness optimally while offering a valuable exit ramp should bullish forces unexpectedly prevail, all within its capital-protected framework, delivering the highest possible payoff the structure was designed to offer.

This analysis is part of our latest Nuts & Bolts series, delving into the sophisticated investment products and capital markets deals shaping Asia's financial landscape. For the previous article in this series, please click here.